Our Deploy360 colleague Aftab Siddiqui chaired a panel discussion about the IPv4 transfer market during APRICOT 2017. The idea was to get the perspective of the IPv4 consumers (buyers), brokers, Regional Internet Registries, and the transfer market facilitators. The growth of the Internet combined with shortages of new IPv4 address, means the market in trading for existing spare IPv4 addresses is buoyant.

Our Deploy360 colleague Aftab Siddiqui chaired a panel discussion about the IPv4 transfer market during APRICOT 2017. The idea was to get the perspective of the IPv4 consumers (buyers), brokers, Regional Internet Registries, and the transfer market facilitators. The growth of the Internet combined with shortages of new IPv4 address, means the market in trading for existing spare IPv4 addresses is buoyant.

The following were part of the panel discussion:

- George Kuo (APNIC)

- David Huberman (Oracle Cloud)

- Amy Potter (Hilco Streambank – Broker)

- Peter Thimmesch (Addrex – Market Place – Broker)

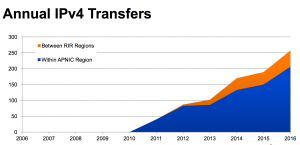

George Kuo presented the APNIC policy which facilitates the IPv4 transfer between members within APNIC region and outside APNIC region. As per the statistics, more than 250 transfers were executed by the APNIC and the majority of them happened within the APNIC region.

David Huberman explained the buyer perspective, the things to consider, and the consequences related to buying IPv4 address space on the open market. There are multiple hidden costs involved other than the per IP cost, such as the broker fee, escrow agent fee, National Internet Registry transfer fee (if applicable), Regional Internet Registry transfer fee, as well as fluctuating exchange rates. On top of this, you may need a lawyer to handle the contractual details.

So the question you need to ask is how much you want to buy, how long will you need to use the IPv4 addresses for, and what is your return-on-investment? If you can make these justifications, you then have to find the resources directly from a seller or through a broker, and diligence is needed. You need to check whether the resource is on any black list, the RIS (Router Information System) for the origin of its last advertisement, and if it’s currently routed then who’s the originator now. If it’s not in the global routing table then ask the seller if they are using it internally and check if there are any existing contractual bindings associated with the resource which may cause legal issue in the future. According to market research, around 30% of market participants are either wilfully or unwittingly offering resources fraudulently, so you need to be careful.

David suggested few points in order to avoid any fraudulent transaction:

- Rigorously vet your seller (broker)

- Do not buy from any party you don’t know or cannot easily find out about

- Only use a major bank as an escrow agent

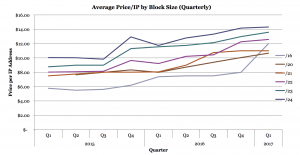

Amy Potter presented the market trends of the last 2 years in terms of pricing with respect to the number of IP addresses. It was strange to discover that the price of a /24 is increasing rapidly because ISPs are asking their big downstream customers such as large enterprises to obtain their own address space; either from an RIR (if available) or from open market because they don’t have sufficient address space to assign.

Her recommendations for acquiring IPv4 resources from the market were as follows.

- Plan as far into the future as you can

- Apply for pre-approval

- Do your diligence

- Structure contracts to minimize risks

Pay attention to your transfer request

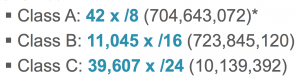

Peter Thimmesch presented some very interesting stats on the basis of research his company has done to identify resource availability. APNIC is the biggest source of supply for IPv4 address space because 45 x /8s were allocated to APNIC and then subsequently around 450 x /16s were also allocated, making approximately 785 million IPv4 addresses. However, APNIC has also seen the maximum number of transfers within the region making it the biggest supplier as well as consumer of IPv4 address space. The secondary source of supply is the legacy allocation, but this is also the hardest to identify.

The unused /8s were easy to identify so they have already been sold off. According to Addrex, there are approximately 8,022 unused /16s that are held by 6,140 entities, some of whom don’t even know they own such resources or are not aware of the block size of their resources and are only using a fraction of these.

During the Q & A session some very interesting points were raised and the most important point was how long will IPv4 last? No-one was able to give a definitive answer because it’s hard to predict how the market will behave in coming years, and it also depends how quickly IPv6 is deployed. There’s currently a big gap between supply and demand that is dictating the price of IPv4 addresses, and it is unclear whether this is peaking or is actually just the beginning of demand that will increasingly push up prices.

What is clear is that the best way to avoid these uncertainties is to start deploying IPv6 and reduce your reliance on IPv4. So please check our Start Here page for more information!